BoR FX Swaps

Main purpose of the operations

A foreign exchange swap (FX swap) consists of simultaneous spot (the first leg) and forward (the second leg) transactions of exchanging one currency against another. The exchange rates of the first and the second legs of the swap are agreed by the parties when the deal is negotiated. The swap points are the difference between the exchange rate of the first leg (the base rate) and the exchange rate of the second leg.

The mechanism of the FX swap presumes the transfer of ownership of the foreign currency, which lowers the credit risk of such transactions in comparison to deposit or secured credit operations and simplifies the resolution of conflicts related to non-performance of obligations by any party to the transactions.

As a monetary policy instrument, the FX swap is mainly used by central banks to provide liquidity in the national currency. The foreign currency, in this case, acts as collateral.

Doubtless, a fully convertible currency is a solid security for any transaction. However central banks do not rely on FX swaps as a sole or main instrument of liquidity provision to credit institutions. First of all, the amount of foreign currency owned by credit institutions may be insufficient. Furthermore, credit institutions need foreign currency to make payments. At the same time, many central banks include FX swaps in their toolkit as an auxiliary instrument. Moreover, as FX swaps are widely used by credit institutions in interbank operations, central banks prefer these transactions to loans secured with foreign currency.

Some central banks put this instrument into practice to provide liquidity for monetary policy purposes, especially in countries with open economy (substantial FX cash flows) and low capacity of the internal market of high-quality securities (which limits the potential for the reliance on securities-backed instruments). Australia and New Zealand are the examples of countries where central banks actually provided liquidity in the national currency through FX swaps.

In 2022 the Bank of Russia suspended FX Swaps (where the Bank of Russia buys a foreign currency spot against rubles and, at the same time, sells it back in a forward transaction on a pre-determined date), which were executed for monetary policy purposes.

Central banks may use FX swaps as an instrument to support financial stability, providing credit institutions with foreign currency. For example, the European Central Bank and the Swiss National Bank used to conduct such operations.

FX swaps executed to support financial stability refer to operations where the Bank of Russia sells foreign currency against rubles and, at the same time, buys them back in a forward transaction on a pre-determined date. The Bank of Russia operates in accordance with the standard market practice.

Main characteristics of the operations

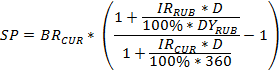

The Bank of Russia sets the following terms and conditions for FX swaps: transaction date, settlement dates for the first and the second legs, base rate, interest rate for rubles, and interest rate for foreign currency, and quotes the swap points in accordance with general market conventions. The central exchange rate for the corresponding currency pair calculated by the National Clearing Centre as of the date of trading conducted by the public joint-stock company Moscow Exchange MICEX-RTS (the Moscow Exchange) is used as the base rate. Interest rates are set by the Bank of Russia Board of Directors. The swap points are calculated as follows.

where

- SP is the swap points in rubles rounded to 4 decimal figures;

- BRCUR is the base rate, which is the central exchange rate for the corresponding currency pair calculated by the National Clearing Centre for the date of trading conducted by the Moscow Exchange;

- IRRUB is the ruble interest rate set by the Bank of Russia Board of Directors, in per cent per annum;

- IRCUR is the interest rate for the foreign currency set by the Bank of Russia Board of Directors, in per cent per annum;

- D is the number of calendar days from and excluding the settlement date for the first leg of the FX swap up to and including the settlement date for the second leg of the FX swap;

- DYRUB is the number of calendar days in a calendar year (365 or 366). If the legs of the FX swap fall on years with a different number of days, the ratio D/DYRUB is calculated based on the actual number of days in each year.

FX swap standing facilities

FX swaps, as a standing facility, were introduced in September 2002. As a result, credit institutions received an opportunity to attract overnight liquidity at the Bank of Russia in exchange for US dollars on a daily basis (the USD/RUB instrument). In October 2005, a similar EUR/RUB instrument was introduced. In 2022 the Bank of Russia suspended Foreign Currency/RUB buy/sell FX Swap standing facilities.

In line with the common purpose of standing liquidity provision facilities, the FX swaps of the Bank of Russia served to achieve the following two objectives. First, they contributed to maintaining the upper bound of the interest rate corridor, since the interest rate paid by credit institutions for ruble liquidity under these transactions was set at the level corresponding to the upper bound of the interest rate corridor of the Bank of Russia. Second, FX swaps allowed the credit institutions that, for some reason, had failed to borrow funds in the money market to draw overnight liquidity at the Bank of Russia with foreign currency as collateral.

Foreign Currency/RUB buy/sell FX Swaps were concluded at the Moscow Exchange with financial market participants that had access to it.

FX swap fine-tuning auctions

In June 2015, the monetary policy framework was supplemented with FX swap fine-tuning auctions. The Bank of Russia could conduct overnight or

The Bank of Russia could decide to conduct a FX swap fine-tuning auction if there was a need to increase the supply of banking liquidity substantially and quickly. An overnight or

The simultaneous conducting of auctions meant, primarily, their unified schedule. Besides, the Bank of Russia announced the total supply amount (allotment), composed the single order book and determined the cut-off rate, below which it would not conclude repo and FX swap deals. The minimum ruble interest rate that could be specified by auction participants in their orders was equal to the key rate. FX swap fine-tuning auctions were conducted at the Moscow Exchange.

FX swap as a financial stability support instrument

The FX swaps, where the Bank of Russia sells foreign currency against rubles and, at the same time, buys them back in a forward transaction on a pre-determined date, are intended for offering foreign currency to banks when they experience FX liquidity shortage for reasons beyond their control. The operations are also used to prevent drastic movements in the FX swap rates in case of short-term surges in market participants’ demand for foreign currency.

FX swaps, as an instrument for providing dollar liquidity support to Russian credit institutions, were first introduced in September 2014, when credit institutions received an opportunity to borrow overnight US dollars from the Bank of Russia in exchange for rubles. The Bank of Russia offers such operations with ‘TOD/TOM’ and ‘TOM/SPOT’ settlements. FX swaps as an instrument for providing euro liquidity support to Russian credit institutions were introduced in February 2022 with ‘TOD/TOM’ settlements. All these operations were suspended due to a drastic change in external economic conditions.

From 19 January, 2023 the Bank of Russia conduct one-day FX swaps, where the Bank of Russia sells CNY against rubles and, at the same time, buys them back in a forward transaction on a pre-determined date with ‘TOD/TOM’ settlements. The CNY interest rate for the purpose of such Bank of Russia’s FX swaps is set at the level of O/N SHIBOR plus 2.5 percentage point. The ruble interest rate is set at the level of the key rate minus one percentage point. The deals are concluded at the Moscow Exchange in the anonymous order execution mode daily from 10.00 to 18.00 Moscow time.