The Central Bank of the Russian Federation is the main issuing bank and monetary regulator of the country.

In 1860, the Emperor of Russia Alexander II signed a decree to establish the State Bank. This was the beginning of the history of the Bank of Russia. Initially, the State Bank was mainly engaged in short-term commercial lending. However, historical developments changed everything. In the 1920s, the bank was a key actor in the restoration of the country’s financial system and the development of exchange relationships. During the hardships of World War I and the Great Patriotic War, it focused on covering military expenditures and the supply of the army and households with money. In the Soviet Union, the State Bank was a lender for the centrally planned economy, issued money and carried out international settlements. In the challenging 1990s, the bank did its best to keep the economy stable and created the system of foreign exchange regulation and control. Following traditions and extensively introducing innovations, today the Bank of Russia is a technologically advanced mega-regulator responsible for the stability of the entire financial system of the country.

State Bank building in Saint Petersburg (view from Sadovaya Street). Postcard. Before 1904

Baron Alexander von Stieglitz, the Governor of the State Bank in 1860–1866

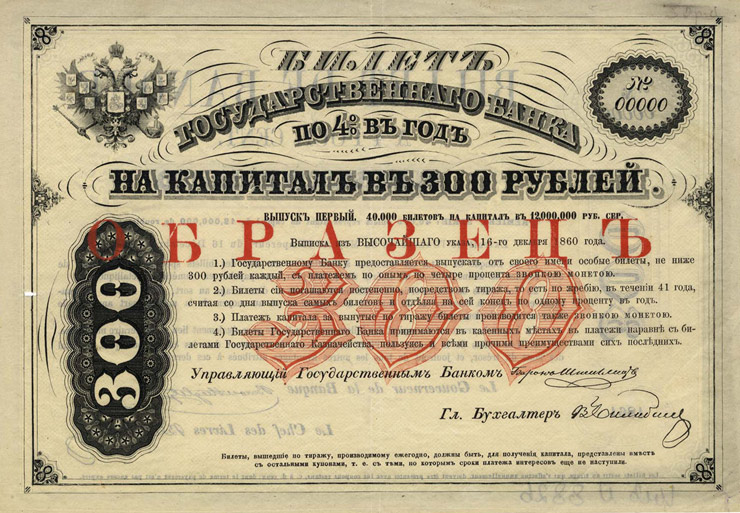

State Bank 4% treasury note for 300 rubles. 1861. Specimen

Rostov-on-Don office of the State Bank. Postcard. 1900s

Ryazan office of the State Bank. Postcard. 1902

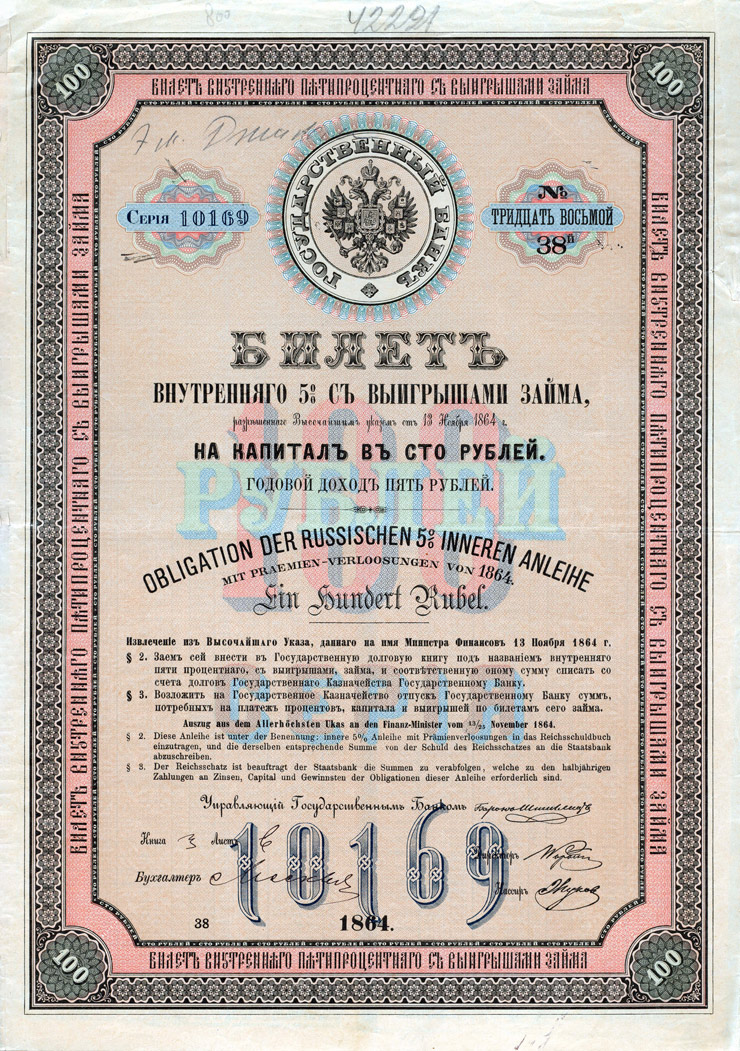

100 silver ruble internal premium bond issued on behalf of the State Bank. 1864 (reprinted in the 1900s)

Irkutsk office of the State Bank. Postcard. 1904–1909

1-ruble currency note with a facsimile signature of Acting Governor of the State Bank Evgeny Lamansky. 1865

Ufa office of the State Bank. Postcard. Before 1904

Evgeny Lamansky, the State Bank’s Governor in 1867–1881

Russian consolidated 4% railroad bond for 125 ‘metal’ rubles (with a facsimile signature of State Bank Governor Evgeny Lamansky). 1880

Yelets office of the State Bank. Postcard. 1904–1909

Moscow office of the State Bank in Neglinny Passage. Phototype. 1890s

Sergey Witte, the Minister of Finance of the Russian Empire in 1892–1903, the author of currency and State Bank reforms

5-ruble currency note (with a facsimile signature of State Bank Governor Eduard Pleske). 1895. Specimen

The State Bank started exchanging credit notes for gold coins and obtained the right to issue banknotes.

Incinerator for destroying old currency notes, the yard of the State Bank building in Saint Petersburg. Postcard, early 20th century.

Yekaterinburg office of the State Bank. Postcard. 1915

Deposit receipt, issued by the Saint Petersburg office of the State Bank. 1907

Vault for storing coins and bullions in the State Bank. Photo. 1909

State Bank Board. Photo. 1909

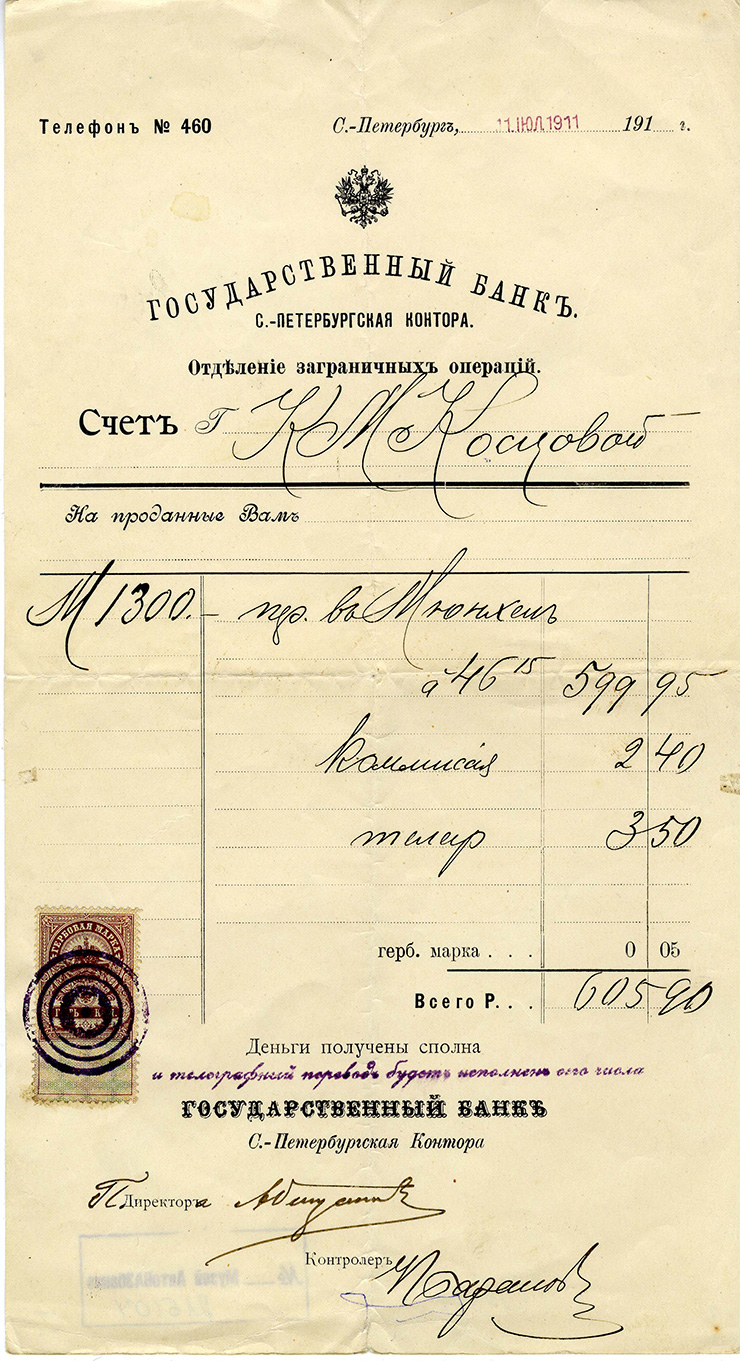

Foreign currency sale and transfer invoice, issued by the Saint Petersburg office of the State Bank. 1911

Elevator of the State Bank near Gryazi railway station. Postcard. 1910s

Propaganda postcard for the 1916 military loan, issued by the State Bank

Propaganda postcard for the 1916 military loan, issued by the State Bank

In November, the Bolsheviks took control over the State Bank in Petrograd.

After a decree was adopted in December about the nationalisation of banks, a state monopoly on banking was announced.

At the same time, a decree on the inspection of bank vaults was adopted. Gold bullions and coins were confiscated and transferred to the national gold fund.

On the premises of the State Bank, its branches and offices controlled by the Bolsheviks, the People’s Bank of the Russian Soviet Republic was established as a part of the People’s Commissariat for Finance. Its main function was the issue of banknotes and their distribution.

After the decree ‘On the Cash Unity’ was adopted, Soviet institutions and organisations had to keep their money and valuables in the People’s Bank or the State Treasury.

A decree was adopted on the merger of treasuries with the institutions of the People’s Bank.

After the adoption of the decree ‘On Foreign Exchange and Precious Metal Transactions’, external settlements were entrusted to the State Bank. It had to establish official exchange rates for precious metals and foreign currency.

RSFSR State Bank Board meeting. Photo. 1922

10-chervonets note of the RSFSR State Bank of the 1922 design (with facsimile signatures of its Chairman Aron Sheinman and Board members)

New banknotes were introduced. One ruble of 1923 equalled 100 rubles of 1922.

The mintage of the Soviet gold coin—chervonets—was launched. One gold chernovets contained 7.74 grams of fine gold, the same content as in the 10-ruble gold imperial coin.

Office of the USSR State Bank Board in Moscow. Postcard. 1920s

The Soviet chervonets started trading on foreign exchanges at gold parity.

A regulation on promissory notes was approved and the instruments became an important source of lending in the State Bank. They were widely used by industrial and trade companies.

Employees of the Birsk office of the USSR State Bank. Photo. 1926

Opening of a USSR State Bank kiosk at a cinema hall in Vyatka. Photo. 1928

Lending to the agricultural sector was entrusted to Gosbank.

3-chervonets note of the USSR State Bank, of the 1932 design (with facsimile signatures of its Chairman Moisey Kalmanovich and Board members Grigory Arkus and Lev Maryasin)

Gosbank was entrusted with the organisation of the purchase, acceptance and custody of precious metals and foreign currency.

The State Bank established the foreign exchange rate at five rubles 30 kopecks per one US dollar.

3-chervonets note of the USSR State Bank, of the 1937 design

Training for kolkhoz instructors taking place at the office of the State Bank of the Komi ASSR. Photo. 1938

Accountant of the Siberian regional office of the USSR State Bank at work (Novosibirsk). Photo. 1938

The encashment service was established under the State Bank of the USSR.

The State Bank of the USSR established a field institution division that provided the army with cash and settlement services. In the early stages of the war, the main objective of field institutions was to provide cash to the troops.

Instruction to an employee of the Leningrad city office of the USSR State Bank. 1942

USSR State Bank Order, dated 13 March 1942, on the operation of its structural units and regional branches

Employees of the field unit of the USSR State Bank on the eve of the offensive operation to liberate Smolensk. Photo. 1943

Considerable financial assistance was provided to state farms and collective farms that resumed their work in the liberated territories and near-front regions.

Paying-in book of a Red Army serviceman (for a deposit at a field unit of the USSR State Bank). 1944–1945

During the war, monetary circulation increased almost four-fold (money worth 54.5 billion rubles was issued into circulation), whereas trade turnover contracted approximately three-fold.

100-ruble note of the USSR State Bank, of the 1947 design

Employees of the Smolensk regional office of the USSR State Bank making a mural newspaper issue. Photo. ca 1948

USSR State Bank employee operating a coin sorting machine. Photo. 1957

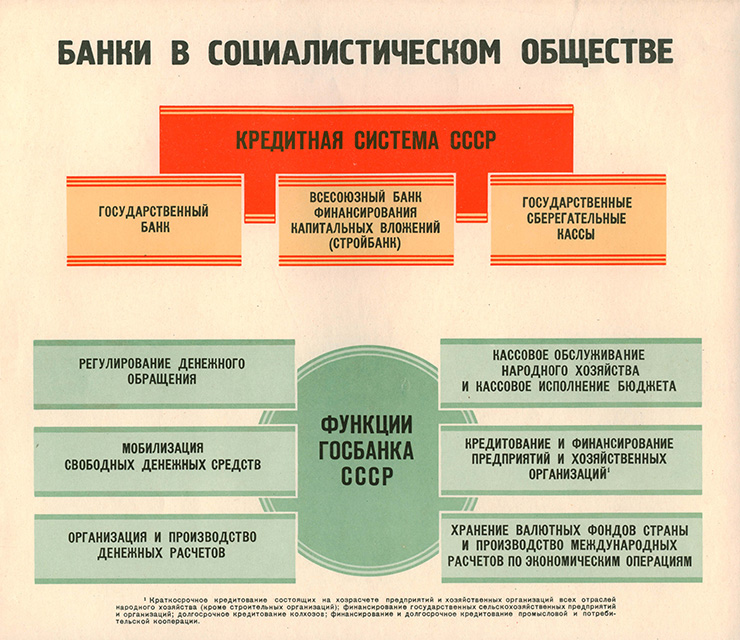

The credit system of the USSR was reorganised. The Agricultural Bank, the Bank for Municipal and Housing Construction Financing and municipal banks were abolished, and their operations were transferred to the State Bank of the USSR and the All-Union Bank for Financing Capital Investments (Stroybank of the USSR).

Until 1987, the country’s banking system consisted of three monopolist banks: Gosbank, Stroybank and Vneshtorgbank.

Growth of investment of the USSR State Bank in the economy in 1932–1958. Study poster (fragment)

Banks in the socialist society. Study poster (fragment). 1960

Economist of the Arkhangelsk regional branch of the USSR State Bank in a helicopter on his way to Severodvinsk to exchange money for new 1961-design banknotes and coins. Photo. 1961

50-ruble note of the USSR State Bank, of the 1961 design

The International Bank for Economic Co-operation was established to provide short-term lending to socialist countries and carry out settlements with them.

At the recounting desk of the Kulunda office of the Altai regional branch of the USSR State Bank. Photo. 1960s

Collectors of the Vladimir regional branch of the USSR State Bank starting their route. Photo. 1971

Receiving cash at the payment desk in a USSR State Bank office. Photo. 1970s

USSR State Bank Board meeting (with Board Chairman Vladimir Alkhimov in the middle). Photo. ca 1980

Ceremonial meeting in the Pillar Hall of the House of the Unions (Moscow), dedicated to the 60th Anniversary of the USSR State Bank. Photo. 1981

Cash desk employee of the USSR State Bank counting small coins. Photo. 1982

Certificate of Commendation of the USSR State Bank Board and the Central Committee of the Public Workers Trade Union. 1985

The fourth and last charter of the State Bank of the USSR was adopted. Its main objectives included an increase in the efficiency of the use of state credit resources, the coordination of banks’ operations in the USSR and the automation of banking operation management systems.

The Russian Republican Encashment Division of Gosbank (ROSINKAS) was founded.

The RSFSR Law ‘On the Central Bank of the RSFSR (Bank of Russia)’ was adopted. The law recognised the bank as the main bank of the RSFSR accountable to the Supreme Soviet of the RSFSR. Its main objectives included the regulation of monetary circulation, ensuring the stability of the ruble, organising settlements and cash services, supervision over joint-stock commercial banks and other credit institutions, and external economic operations.

For the mintage of coins in the denomination of 10 kopecks, steel billets plated with tombac (copper and zinc alloy) were used. The ten-ruble coin was for the first time made of two parts: a ring made of an alloy of copper, nickel and zinc (German silver) and a brass disk.

The Central Bank of the RSFSR was recognised as the sole body of state monetary and foreign exchange regulation in the republic.

Moscow, 19 August 1991. Armoured vehicles in front of the USSR State Bank building

The Bank of Russia received the monopoly right to issue money in the Russian Federation. The Bank of Russia issued its first business strikes and banknotes. The coins featured the image of the double-headed eagle without crowns, sceptre and orb created in 1917 by Ivan Bilibin for the national emblem of the Russian Republic. In 2001, this image became the basis for the official emblem of the Bank of Russia.

The Bank of Russia issued its first commemorative coin in the denomination of one ruble. It was made of cupronickel (an alloy of copper and nickel) and dedicated to the anniversary of Russia’s independence.

The market exchange rate of the ruble against foreign currencies was based on the results of trading at the Moscow Interbank Currency Exchange.

The process of transmission of the functions of cash execution of the state budget to the newly established Federal Treasury was launched.

The Bank of Russia stopped extending direct loans to finance the federal budget deficit and providing centralised loans to individual sectors of the economy.

On 12 April, the State Duma adopted the Federal Law ‘On the Central Bank of the Russian Federation (the Bank of Russia)’. The law assigned the Bank of Russia the functions of issuing bank, refinancing of commercial banks, banking regulation and supervision, foreign exchange regulation and foreign exchange control.

Small coins and business strikes of the Bank of Russia in the denominations of 1, 5, 10 and 50 kopecks and 1, 2 and 5 rubles were issued. The image of Saint George was the main element in the design of the small coins. The business strikes featured the Bank of Russia emblem—the double-headed eagle without crowns, sceptre and orb.

The Bank of Russia issued its first commemorative banknote. The note, in the denomination of 100 rubles, was dedicated to the XXII Winter Olympic Games and XI Paralympic Games in Sochi in 2014.

The Bank of Russia approved the symbol for the ruble selected in a popular vote.