Bank of Russia releases its first review of financial inclusion in Russia

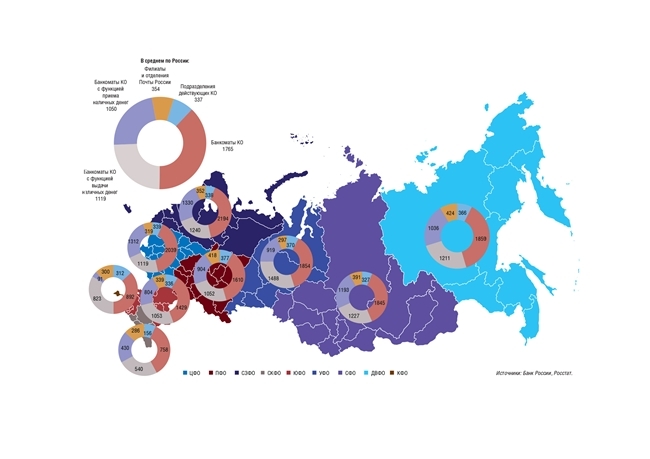

The review contains comparative data on the current infrastructure of financial services in Russia (the number of banks, microfinance organisations, consumer credit cooperatives, insurance companies, pawnshops, ATMs, payment terminals, etc. in various regions of the country), as well as a detailed description of how much financial services are in demand with the population / small and middle enterprises (SME) and the level of user satisfaction.

The data on financial service infrastructure enable a comparison of some 2014 and 2015 indicators, a time the Russian economy entered a deep economic crisis, exacerbated by an adverse external environment including lowering oil prices and foreign sanctions.

The review data provide insights into which of financial services were most in demand with the adult population, depending on sex, age, employment type and place of residence, and also which financial instruments were most popular in 2015 with SME across the country.

According to the International Monetary Fund’s estimates for 2014, most Russian financial inclusion indicators were comparable with those for G7 countries. In such a way, in the number of operating banks per 100 thousand adult citizens, Russia is preceded only by Italy and France, while in the number of ATMs it is overtaken by only Canada.

The year of 2015 saw the number of banking units drop 11.2%; however, there was a substantial growth in the number of payment terminals of bank and non-bank paying agents (16.2% and 74.7%, respectively). Also, the data showed a 5% rise (to 39.5%) in the share of adult population who, in their own view, can access their bank accounts remotely for fund transfers. In this way, the advance of remote and digital financial services came to set off the dwindling physical access in the country’s remote regions.

As regards demand for financial services, the review shows that almost every third adult Russian took on a bank loan. Middle age citizens aged

The study also features data on how the adult population uses property, life and other insurance services, depending on age and sex, employment type and the type of respondents’ residential area. Overall, as many as 16.4% of Russian adults were users of voluntary insurance services in 2015, while the coverage of mandatory insurance was 63.2%.

The data in the review suggest that bank accounts are most often accessed remotely by younger users aged

In Russia, 37.9% of adults have only payroll cards, 19.9% have only another settlement (debit) card in addition to the payroll one, while 14.2% of adults are holders of both types. The highest share of payroll card holders resides in Ural Federal District (62.3% of adult population of the district), while the Far East (56.7%) leads in the numbers of non-payroll card users. As many as 22.5% of Russians own active credit cards.

Adult users in the Far Eastern Federal District are leaders in terms of money transfers enabled by e-wallet, a payment system or a bank card / account (here this share of the adult population stands at 61.7%).

The section containing evaluations for quality of financial services presents data on which regions lead when the population voluntarily declines to take on a loan, to place a deposit or to get optional insurance services, and why. For example, as many as 22.8% of Russians declined to take on a loan due to a high interest rate; the largest share of those forbearing from loans falls on adults in households with

The review also offers insights into residents of which districts are most mistrustful of bank and microfinance organisations. A mere 4% of adults are reported to have total mistrust towards a financial institution of any kind. The paper also notes an ongoing growth in the level of credibility of financial institutions (banks, microfinance organisations, consumer credit cooperatives, pawnshops and insurance businesses). However, the authors make reservations as regards their findings on microfinance services, stating that over 81.2% of respondents have either, seemingly, never dealt with this financial service or gave no answer. Only 31.5% of adult Russians proved capable of evaluating the insurance market.

The study also seeks to measure the degree to which the population understands the economic content of key financial terms. Data from Moscow and St. Petersburg suggest that only 45.3% of the adult population are really aware of what interest rate is, while the share of such rural population stands at 49.6%. Compound interest is best understood by residents of small-sized cities of

The majority of Russian citizens have the opinion that life quality has improved thanks to active financial services (60.7%), contrasted with a mere 8.3% of those noting bad impact, while the rest claimed their quality of life was unchanged.

The review notes that almost a fifth of SME (17.8%) in the period under study had an active secured bank loan and almost as many (17.6%) — an open credit line. According to the findings, small and medium business owners tend to take a considerable part of loans on behalf of an individual, which is most often the case of Siberian Federal District (22.8%). Small and medium enterprises are a lot less active when it comes to taking loans from microfinance organisations, with a mere 1.2% of such loan consumers, which is likely explained by the lack of awareness among first-time entrepreneurs as regards the state support to SME available through this financial market segment.

When asked about their satisfaction over the use of microfinance loans, 92.6% of SME owners admitted to have never dealt with the service or checked ‘Cannot say’. Also, SME is reported to use both leasing and factoring very scarcely: over 90% of all respondents have either never dealt with factoring or gave no answer to the question on service satisfaction; only 31.2% of enterprises were able to evaluate the quality of a leasing service.

As the authors evaluate financial services available to SME, they rate the regions in terms of obtainability of an unsecured loan; the ranking is led by Northwestern Federal District.

In general, as many as 71% of SME respondents noted their satisfaction with their bank service. Also, the review presents their assessment of potential availability of stop-gap funds, with a quarter of entrepreneurs being confident they would receive such funds if the need should arise and another 45.6% of respondents thinking that they would most likely succeed in obtaining these funds.

The review is built on financial inclusion indicators for 2014 and 2015, for which the Bank of Russia made respective measurements in 2015 and 2016. The indicators include both financial institutions’ statements and adult population / SME polling data.

Moving forward, the Bank of Russia intends to issue financial inclusion reviews on an annual basis. There are plans to supplement the set of such indexes, by as early as 2017, with SME development indicators for financial service quality and usability, as well as with assessments for financial awareness of households.

Furthermore, the Bank of Russia intends to develop, before the end of 2017, a

Among key activities in the implementation of this strategy will be steps to promote financial awareness among citizens and SME, SME funding, digital channels of financial services, access to financial services in remote and rural areas, as well as future improvements in the framework for protection of financial consumers.

The objective to measure the level of financial awareness is in particular focus, including the efforts to identify factors which encourage the population to improve their financial literacy, as well as the drive to understand the educational needs of SME communities in the field of financial services.